How to Print GST-Enabled Invoices & Packing Slips for Your eCommerce Website

Ecommerce Tips & Tutorials

Running an eCommerce business on platforms like Shopify and Wix is not just about selling products. It also requires handling accurate order documentation for compliance and smooth logistics management. One of the most critical tasks for Indian businesses is generating GST invoices and GST-enabled packing slips. Without proper invoice compliance, you may face taxation and record keeping issues.

The ILS Portal makes this process simple. It offers a GST invoice Shopify Wix integration that allows businesses to generate GST invoices and packing slips in just a few clicks. You can print, customise, and maintain your invoice number history while ensuring that your branding and customer details are consistent across every document.

Also Read: https://ilsportal.io/blogs/how-to-write-address-on-envelope

Why GST Invoices and Packing Slips Matter for eCommerce

Every eCommerce business in India must issue GST invoices showing tax details, order information, and payment status. At the same time, packing slips are used in logistics management to make sure the correct products reach the customer. When both are printed together, they help streamline operations.

Key reasons they matter include:

- Invoice compliance with GST regulations

- Transparency in payment status for customers

- Accurate logistics management through packing slips

- Easy order documentation for future reference

- Professional invoice templates that reflect your brand

How to Generate GST Invoices for Shopify and Wix Orders

Shopify and Wix do not provide GST-compliant invoices by default. That is why most sellers use third-party apps such as the ILS Portal.

With the ILS Portal, GST invoice printing for eCommerce orders becomes simple, with the order sync, GST invoice generator, print and download, and invoice number history. This approach saves time while maintaining compliance.

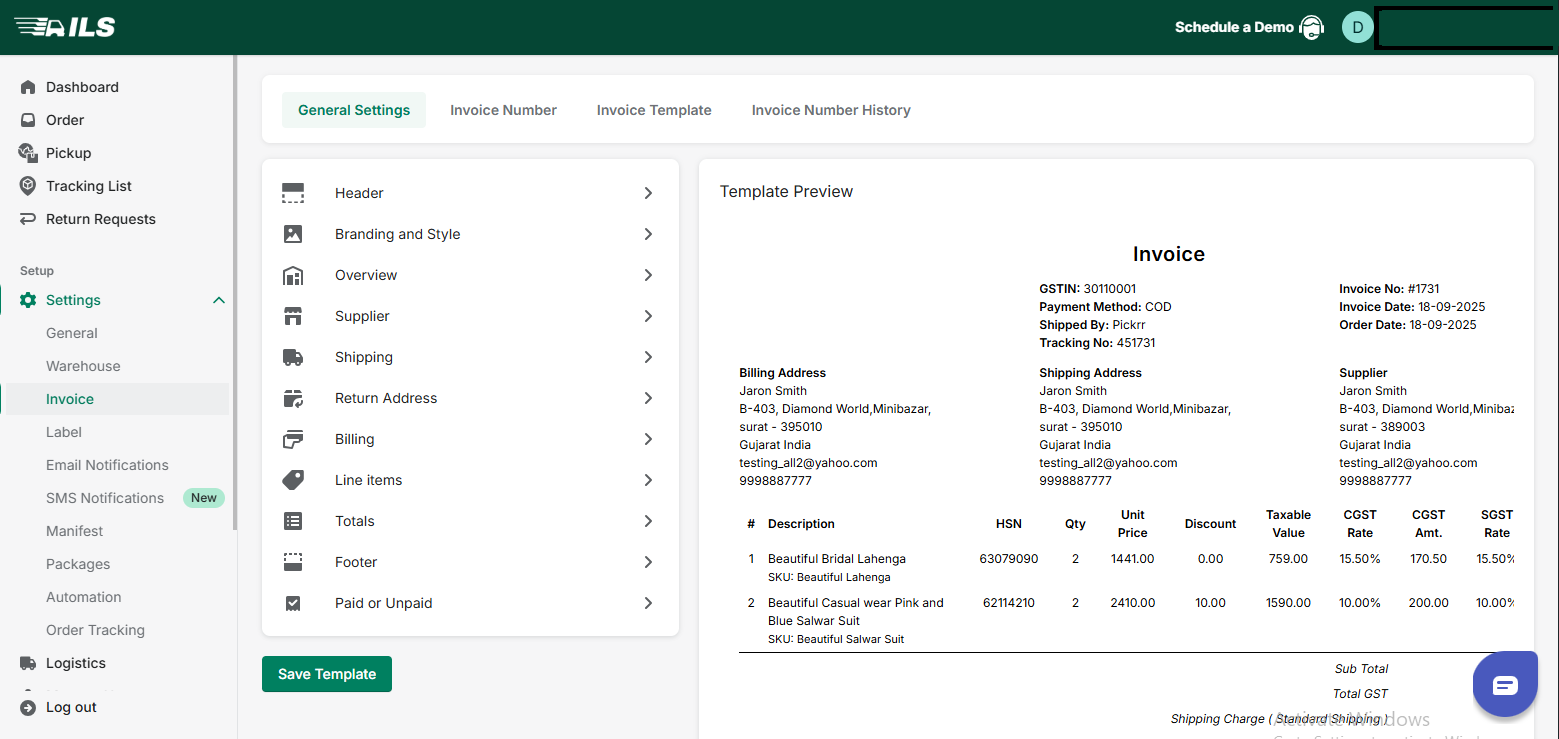

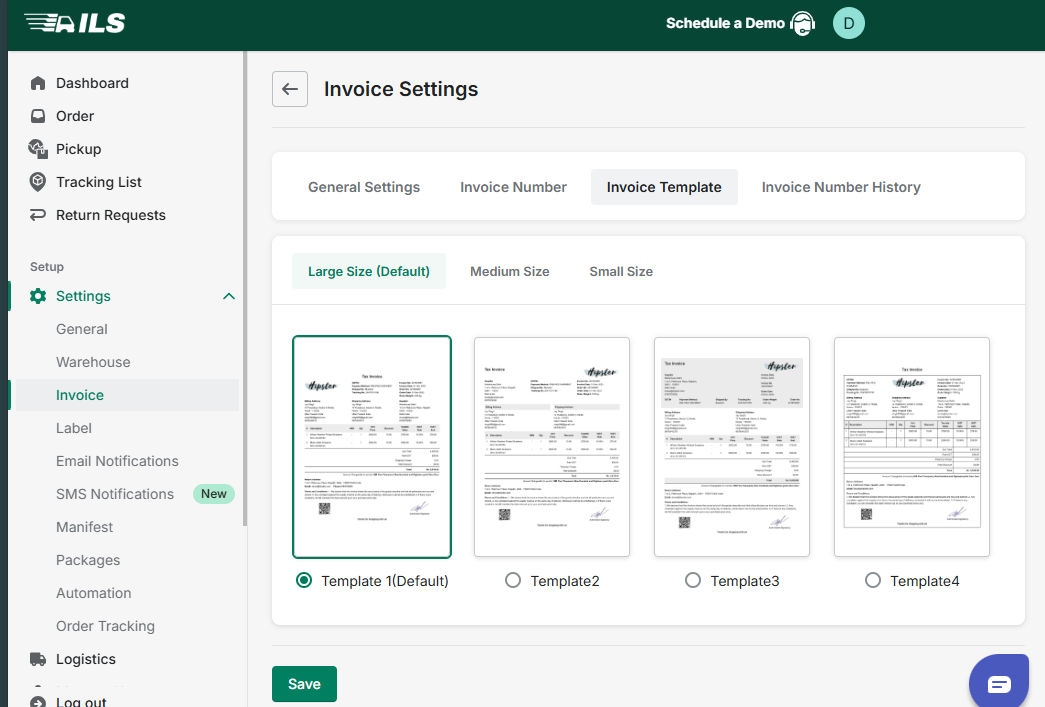

Customising Packing Slips and Invoice Templates

Every business has unique requirements for its invoices and packing slips. The ILS Portal allows complete customisation to match your business needs. Here is what you can customise:

- Invoice Number Customisation

- Invoice Header Customisation

- Invoice Footer Customisation

- Invoice Column Customisation.

- Invoice Billing Detail Customisation

- Invoice Shipping Address Customisation

- Invoice Return Address Customisation

- Invoice Supplier Detail Customisation

- Invoice Branding & Style Customisation

- Invoice Overview Customisation

This level of flexibility helps businesses maintain consistency in branding and documentation.

Printing GST Invoices and Packing Slips Together

For busy eCommerce sellers, printing invoices and packing slips separately can take unnecessary time. The ILS Portal provides a GST packing slip generator that combines both documents into a single printable format. This saves effort and reduces errors during order fulfilment.

Advantages of printing both together:

- Quicker logistics processing

- Less paper waste

- Accurate order documentation

- Easy verification before dispatch

Invoice Number History and Order Documentation

Maintaining an invoice number history is not just for compliance but also for efficient order tracking. With the ILS Portal:

- All invoices are recorded systematically.

- Businesses can search past invoices by customer name, order ID, or date.

- Records are available for GST filing or audits.

- Payment status on the invoice is visible for both you and your customer.

This avoids confusion and keeps your documentation well organised.

Table: Key Customization Options with ILS Portal

| Customization Feature | Purpose | Benefit for Business |

|---|---|---|

| Invoice Number Customization | Format invoice numbers | Easier tracking and compliance |

| Invoice Header Customization | Add brand logo and GSTIN | Stronger brand identity |

| Invoice Footer Customization | Add terms and notes | Better communication with customers |

| Invoice Column Customization | Choose which details to display | Flexible documentation |

| Invoice Billing Detail Customization | Control billing fields | Professional and clear invoices |

| Invoice Shipping Address Customization | Accurate shipping info | Smooth logistics management |

| Invoice Return Address Customization | Add return location | Hassle-free returns |

| Invoice Supplier Detail Customization | Include supplier GSTIN | Compliance with GST laws |

| Invoice Overview Customization | Decide how totals are shown | Easier reading for customers |

| Invoice Branding & Style Customization | Change fonts and layouts | Branded, professional invoices |

How ILS Portal Helps eCommerce Businesses

The ILS Portal is designed for modern eCommerce businesses on Shopify and Wix. Its GST invoice printing feature, packing slip generator, and customisation options help you run a compliant and professional operation. Beyond invoices, the platform supports bulk order processing, seamless package uploading, and real-time tracking.

By centralising all your order documentation, the ILS Portal reduces manual work and improves accuracy. Sellers can spend less time worrying about compliance and more time focusing on growth.

The ILS Indian Logistics Services app makes GST invoice printing and packing slip generation seamless for both Shopify and Wix sellers. With this integration, you can automatically generate GST-compliant invoices, maintain invoice number history, and customize invoice templates without switching between multiple tools.

You can install the app directly from:

With the ILS Portal, sellers on both platforms can manage invoices, packing slips, and logistics within their store, making the process faster, compliant, and reliable.

Final Thoughts

For eCommerce businesses in India, GST invoices and packing slips are more than just paperwork. They build trust with customers, maintain invoice compliance, and simplify logistics management. The ILS Portal offers a reliable GST invoice Shopify Wix solution with features like invoice number history, customisable invoice templates, and combined invoice and packing slip printing.

By using this tool, sellers can confidently manage their order documentation while keeping their branding professional and operations efficient.

Frequently Asked Questions

How do you generate GST invoices for Shopify orders?

Shopify, by default, does not provide GST-compliant invoices. You can use apps like the ILS Portal to generate GST invoices for Shopify orders.

What is the easiest way to print GST invoices and packing slips together?

The ILS Portal provides a GST packing slip generator that allows you to print invoices and packing slips in a single document. This saves time during order processing and ensures accurate logistics management.

Can I track the history of invoice numbers for compliance?

Yes. Every invoice generated through the ILS Portal is stored with a unique invoice number. This helps businesses keep a proper invoice number history that can be accessed for audits, GST filing, and customer queries.

Does the invoice show payment status?

Yes. GST invoices generated via the ILS Portal can display the payment status on the invoice. This helps customers and sellers confirm whether an order has been paid for or is pending.

Can a return address and supplier details be added to invoices?

Absolutely. The ILS Portal includes customisation for the invoice return address and supplier details. This allows businesses to add a warehouse or supplier's GSTIN and contact details.

How do invoice templates help in branding?

Invoice branding and style customisation in the ILS Portal let businesses add logos, colours, fonts, and layouts that reflect their identity. This makes invoices look professional and consistent across all customer touchpoints.

Does the ILS Portal work with Wix and Shopify?

Yes. The GST invoice Shopify Wix integration is available for both platforms. Whether you run your store on Shopify or Wix, the portal helps generate invoices, packing slips, and order documentation seamlessly.